A short strangle consists of one short call with a higher strike price and one short put with a lower strike. Both options have the same underlying stock and the same expiration date, but they have different strike prices. Since you are selling both the put and the call, you are collecting premium. As long as the stock price doesn’t go below the put strike, OR go above the call strike, you pocket the premium.

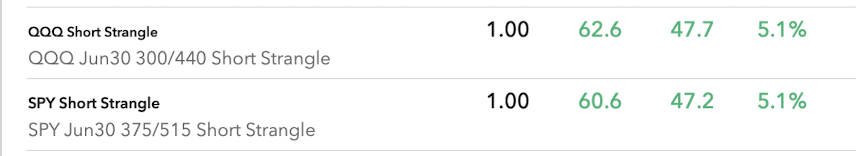

These are the trades I recently placed. Remember, short strangles carry UNLIMITED risks.

QQQ

What I am betting on is that QQQ is range bound between $300 and $400 from now to June. If that’s the case, I’ll pocket $9 (which is $900. Remember, each option multiplier is 100. Refer to this “what are options!” to learn more.)

- sell QQQ June 30 300 PUT

- sell QQQ June 30 400 CALL

I’ll start losing $$$ if QQQ dips below $300-$9, OR, QQQ goes above $400+$9.

SPY

Similar idea. I am betting SPY will be range bound between $375 and $515 from Jan to June.

- sell SPY June 30 373 PUT

- sell SPY June 30 515 CALL

Bookmark this page and come back for an update. I may not choose to hold these options till expiry. I rarely do.